Media | Perth’s build-to-rent sector grows and evolves to meet to needs of the state’s residential market, Rothelowman Principal Kylee Schoonens is featured in Business News

This article was originally published in businessnews.smedia.com.au written by Claire Tyrrell.

Build-to-rent sector evolves

Developers in the burgeoning build-to-rent sector are adapting their projects to current market conditions.

Stuart Hawley and Daniel Rainone. Photo: Claire Tyrrell

Stuart Hawley’s approach to property development has in many ways been informed by his experiences in the rental market.

The Bluerock Projects director moved away from home ownership in 2018 to set up his company, which specialises in build-to-rent (BTR) projects.

“I’m a renter myself. I understand what it’s like to be in the rental market, and have for years,” he said.

“I actually see there’s a great future in it [BTR].

“I remember buying a house. I’ve done it up and made no money and I just went ‘you know what, this has just got knobs on it’.”

Mr Hawley and Bluerock Projects senior development manager Daniel Rainone plan to deliver the company’s first major project with a $25 million BTR apartment building in Midland.

In 2019, Bluerock built a four-storey apartment complex on The Crescent in Midland as a pilot project, comprising seven BTR dwellings and two build-to-sell apartments.

Mr Hawley came across the land for that development, known as DeHavilland, in 2018 when he was working at ASX-listed land developer Peet.

“I was sitting in a cubicle, and we were looking at land,” Mr Hawley said.

“DevelopmentWA had approached [us] and [told us of] some blocks in Midland.

“The company I was working for said ‘that’s not our thing’.

“I looked at it and thought we could do something with it, and that’s when I sold the house.”

Mr Hawley, who has a background in commercial building, used timber-frame construction to build DeHavilland.

Bluerock Projects is taking this approach to its new Midland BTR development, Tuohy Gardens, which it plans to build later this year.

At 51 apartments, it will be the state’s largest timberframe apartment building. It’s a material Mr Hawley and Mr Rainone are passionate about.

Both the DeHavilland and Tuohy Gardens projects feature affordable dwellings.

“The build-to-rent market, typically in Australia and Europe, focuses on middle to high-end rental properties,” Mr Hawley told Business News.

“However, Americans are across the entire span of the sector, so they have plenty of affordable build to rent.

“They use timber construction like we do, so essentially, we’re looking at rolling out that market sector here in WA to try and tap into the demand for affordable rentals.”

If all goes according to plan, Bluerock Projects will have delivered up to 500 BTR apartments in WA, all using locally sourced timber.

“We see tremendous growth in the space that we operate in,” Mr Rainone said.

“We have a pipeline program, where we are looking to deliver a lot more projects like Tuohy Gardens, and a lot larger as well, fifty-one apartments in Midland might lead to 120 or 140.”

Recent data from Knight Frank Australia shows the build-to-rent sector is continuing to grow across the country, with national BTR stock expected to reach 55,000 dwellings by 2030.

Melbourne leads the market with projects there making up 45 per cent of the national BTR pipeline, representing 4,920 units under construction and 8,250 approved.

This is followed by Queensland at 27 per cent, while WA only makes up 4 per cent of the national BTR market.

Urbis data shows there were 7,905 dedicated BTR units in Australia in 2023, with that figure expected to almost double to 13,450 this year.

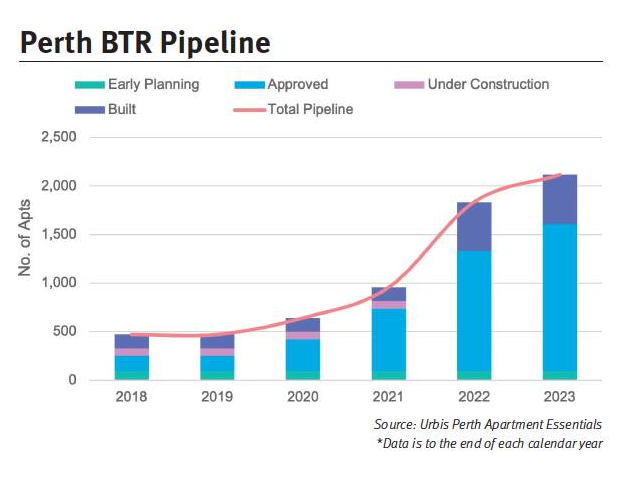

In WA, there are 505 BTR apartments, with 2,115 in the pipeline.

The consensus among BTR proponents is that the sector is poised for rapid growth, with an undersupply of housing and strong rental yields dominant factors in WA and other states.

However, recent increases in build costs have hampered the rollout of several projects in the BTR space, particularly in WA.

Market impacts

Australian Development Capital, or ADC_, which is behind Perth’s largest proposed BTR development at Perth Girls School, is in the process of revising its plans for the East Perth site.

As the company’s executive director Rod Hamersley explained, challenges around builder availability meant the project would be delivered in stages rather than all at once.

Additionally, the number of BTR apartments planned for the northern part of the Girls School site will be reduced to 400, from 500.

“What we’ve been doing this year is looking at some staging options for the northern portion of that precinct, which is where the BTR is proposed,” Mr Hamersley told Business News.

“Given the challenges we’ve been facing with the availability of building contractors, we’ve looked to stage that northern site so we can do it in small chunks, basically.”

He said breaking the project down into smaller stages would open it up to more builders than if it was a single large development.

ADC_ is working with community housing providers, given the development’s significant social and affordable component, after initial partner Assemble left the project last year.

The developer is also narrowing down institutional players to back the project financially.

Despite some reports of institutional capital flocking to eastern states BTR projects, Mr Hamersley said WA developments were not being held back by a lack of funds.

“The build-to-rent model is very much institutional and super fund backed, and from what we understand from talking to the players in that space there’s no shortage of capital,” he said.

“[T]he issue we’ve faced in WA has been just the escalation of construction costs, which has made the feasibility of it very difficult to make stack.”

Mr Hamersley said construction costs had levelled off in recent months while rents continued to grow, both enhancing the feasibility of BTR.

Government incentives, too, including the recent 50 per cent land tax concession for BTR developments in WA, helped, he said.

Bluerock Projects’ proposed Midland BR development Tuohy Gardens. Image Rothelowman

Sydney-based EG Funds Management, which has approval to build a $135 million predominantly BTR apartment project in Leederville, shares ADC_’s view on capital availability.

EG Funds Management development director Grant Flannigan said a tendency for some investment groups to be hesitant to divert funds to WA projects was “lazy thinking”.

“I can understand why some developers might be saying that, but it shouldn’t be a barrier, because the fundamentals in Perth are as good as anywhere in Australia,” Mr Flannigan told Business News.

“All the metrics that you would normally [look at] when considering an investment in build to rent are more or less the same across Australia, so it should be geographically agnostic.”

EG Funds’ Leederville project, its first BTR in WA, received development approval in December 2022. However, there is no firm date on a construction start.

The Frame Court site is currently occupied by the Water Corporation, and the project timeline will depend on when the state government utility vacates the building.

EG Funds has also been affected by increases in construction prices and a reduced availability of commercial builders in WA.

Mr Flannigan said he had not seen the current level of cost escalation for construction projects at any time during his 35 years in the industry.

“At the moment, construction costs are just a problem,” he said.

“It doesn’t matter where you are, they’re a problem for everyone.”

Global developer Sentinel Real Estate, which brought the BTR model to Perth with its Element 27 (now Elements) project in Subiaco in 2019, is similarly hamstrung by increased construction costs.

Sentinel is yet to deliver the final two stages of its Elements project, despite indicating it was ready to launch into the third stage in mid-2022.

The company is in discussions to appoint a contractor for the third stage of the Subiaco development and is working through planning of the fourth stage.

Initially, the project was touted as a three-stage build.

Sentinel Real Estate managing director Keith Lucas said there was extremely high demand for BTR in WA, reflected by the fact its Subiaco apartments were close to full occupation.

He said the BTR model, which was far more established in Sentinel’s US home base, had significant potential in Perth.

“Australia’s build-to-rent market is still in its nascency compared to other parts of the world,” Mr Lucas said.

“We expect that, over time, it will grow into a larger, more-established real estate asset class across the country, including in WA.

“The current housing shortage has put a shining light on the important role that build-to-rent developments can play in delivering more quality rental housing, and the easing of headwinds such as construction cost escalation and labour shortages will be key to enabling the industry to deliver a greater number of projects of this type at scale.”

Sentinel’s proposed BTR tower in Scarborough has hit several hurdles, with initial construction flagged for late 2021.

Challenges in the market pushed that out to late 2022, when the timeline was revised once more.

Sentinel could not provide a firm construction date on its Scarborough project, which is set to add 175 BTR apartments to the market.

“We are currently working through delivery strategies as it relates to appointing a building contractor and progressing works on our site in Scarborough,” Mr Lucas said.

“Given some of the industry-wide challenges facing WA’s construction sector, we are approaching this process with a great deal of review and analysis.”

Celsius Property Group is planning its first BTR development in Shenton Park. Image: Rothelowman

BTR difference

East Victoria Park-based developer Celsius Property Group is planning its first BTR development, in DevelopmentWA’s Montario Quarter precinct in Shenton Park.

Currently in the public consultation phase, the project comprises 230 units, half of which will be either one-bedroom or studio apartments.

Celsius Property Group director and project manager Matt Evans said this configuration marked a departure from many current build-to-sell apartments, which were more commonly larger dwellings.

He said the proliferation of larger apartments was distorting the market, with more smaller dwellings needed to help address housing affordability.

Celsius managing director Richard Pappas said the company decided to pursue the BTR space because it recognised a clear need for the product and strong market fundamentals.

“There’s low rental vacancy and long-term strong population growth,” he said.

“BTR can accommodate tenants where they want to live; Montario Quarter in Shenton Park has given us that opportunity on key transport links.”

Mr Evans said the sector had a role in helping the government meet its objectives to house more people in areas close to transport links.

“There are massive opportunities,” he said.

“Look at Metronet hubs. It’s sometimes difficult for the build-to-sell developers in these locations, but BTR can come into the area and deliver an immediate population boost that anchors the precinct and makes new commercial amenity viable.”

While industry players have welcomed the state government’s land tax concessions for BTR developments, they say more can be done.

As Mr Hawley explained, BTR developers would welcome being able to claim GST in the same way as traditional developers.

“The land tax thing is great to have, but what we really need is the GST,” he said.

“When you do a development to sell it, you can claim the GST on the way through from your construction costs, but we have to hold it.

“If they [the federal government] did that, it would open up the whole sector overnight on a massive scale.”

Mr Pappas agreed that all levels of government should be doing everything in their power to entice more development in the sector.

National architecture firm Rothelowman is working on both Bluerock Projects’ development and the Celsius Property Group plans.

As the firm’s Perth principal Kylee Schoonens explained, the studio was well acquainted with the differences between BTR projects and more traditional apartment buildings.

“Rothelowman is currently delivering probably over twenty per cent of the build-to-rent housing supply nationally, so we’re working for a lot of build to rent operators,” Ms Schoonens told Business News.

“There are a lot of design nuances that require build to rent to be different from a build to sell, particularly from the operational perspective, so understanding the mechanics of that and how they operate [is important].”

Ms Schoonens added that architects needed to consider the frequency of resident turnover, which was often higher than in a traditional apartment complex, as well as making dwellings adaptable.

She said there was growing interest in the build-to-rent sector and felt optimistic about activity in BTR this year.

“I think 2024 will be a breakout year for build to rent, certainly with the rental market increasing,” Ms Schoonens said.

“Land value in WA is still relatively cheap compared to the east coast as well, particularly around the city.

“There is a lot more interest that will start to come from operators on the east coast as well.”

This article was originally published in businessnews.smedia.com.au written by Claire Tyrrell.